25+ 50000 mortgage calculator

Calculate Annual Percentage Yield using our APY Interest Calculator. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates.

Does Annum Mean A Month Or A Year Quora

If you make higher overpayments you can further shorten your loan term and reduce your interest costs.

. That is why our mortgage and GIC rates are among the best in our market. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A customer with a 300000 home loan over 25 years had an offset account linked to the home loan for the entire loan term with a constant balance of 50000 in it they would only pay interest on 250000 for the entire loan term.

It will also remove more than 1 year off a 25-year mortgage term. The Ultimate Mortgage Calculator calculates mortgage payment amount term down payment or interest rate creates payment plan with dates points and more. Our mortgage calculator helps by showing what youll pay each month as.

If the borrower makes an extra. Product APY 4 Rate. More information on this mortgage.

Your Mortgages Negative Gearing Calculator can help in revealing the possible tax benefits that may be available to you as the residential investor if you decide for your property to be negatively geared. You can use our loan calculator to compare a range of 50000 loans from popular lenders based on monthly payment size and APR. Looking to run an amortization schedule for a 50000 10YR loan 3 with Bi-weekly payments of 500 on the 1st and 250 on the 15th of each month.

351 Fixed to 31032028 From HSBC. Qualified homeowners receive the money as a zero. If your home is worth 200000 and your first mortgage has a balance of 110000 then the amount due on that mortgage is 55 of the homes value.

Consider this example if you want to maximise your savings. County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. You would make approximately 300 payments averaging about over the course of 25 years. If you opt for biweekly accelerated.

Mortgage offset calculator to show how much time and interests you can save through mortgage offset. 15 yr jumbo fixed mtg refi. Certificate of DepositCDs For product details and requirements click on product name to learn more.

Borrow up to 50000 for a used. You can deduct 50 a week from your taxable income and hence. 50000 - 99999 025 On this portion.

Based on a 200000 mortgage at a fixed 3 APR you can save over 5000 if you make an overpayment of 50 per month. Simply enter how much you want to borrow how long you want the loan for the value of your property and mortgage then well find you the loan that could best suit your situation. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

How to use our 50000 repayment calculator. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Using our mortgage rate calculator with PMI taxes and insurance.

After your tax refund of 9625 the actual cost is just 375. Mortgage Calculator For Over 60s - Compare Mortgage Rates - Calculate Fixed Variable Deals - FREE Mortgage Calculator - Latest UK Lender Options For Moving Home Or Remortgaging. The total cost of a 120000 mortgage over 25 years is 212007.

Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. Enter your annual salary to view a full tax calculation About the Tax Calculator. Initial rate 351.

Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022. A mortgage is one of the biggest commitments youll make in your financial life. Another program is the Principal Reduction Program that can help homeowners with up to 50000 to reduce the loan-to-value ratio.

A chattel mortgage calculator comes up with a repayment amount based on the information you provide using basic arithmetic. ICalculator India Income Tax Salary Caluclator updated 202223 assessment year. The repayment period must be a minimum of 1 year and a maximum of 30 years.

Learn how competitive interest rates can help your money grow faster. But with so many possible deals out there it can be hard to work out which would cost you the least. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments.

Income Tax calculations and NIS factoring for 202223 with historical pay figures on average earnings in India for each market sector and location. 71 ARM refi. With a few key details the tool instantly provides you with an estimated monthly payment amount.

Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home. Home Buying.

You may also enter extra lump sum and pre-payment amounts. This would mean that if a lender has a max LTV of 80 a borrower could borrow up to an additional 25 of the value of the home 50000 via either a home equity loan or a home equity line of credit.

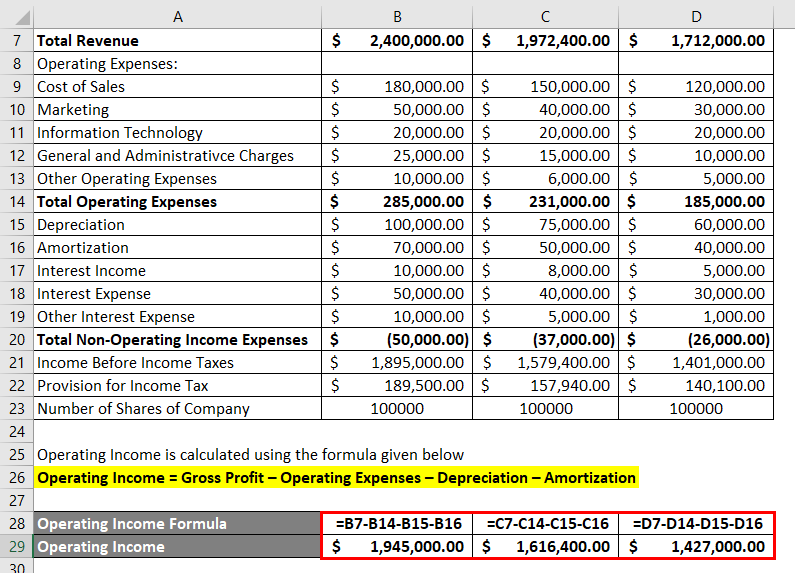

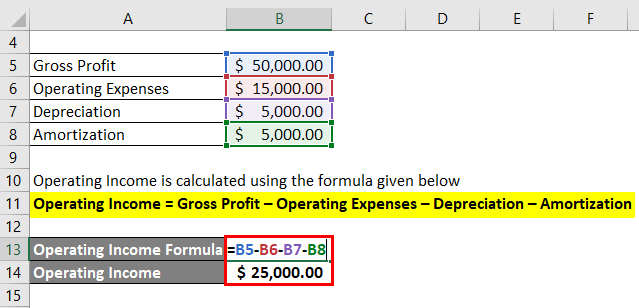

Operating Income Formula Calculator Excel Template

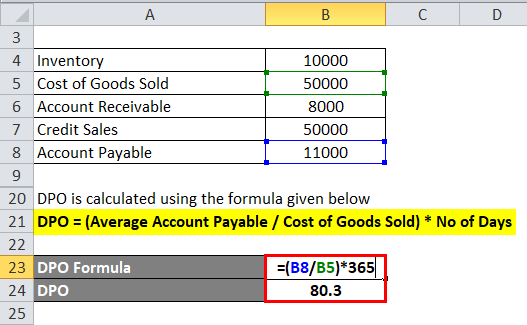

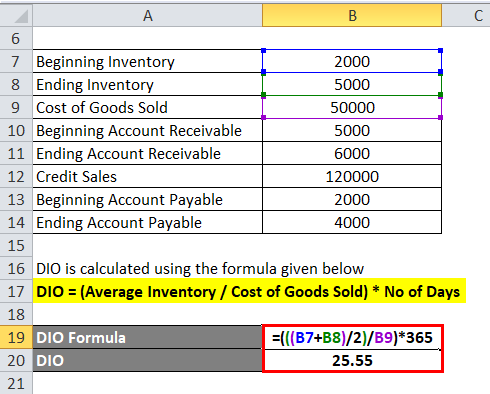

Cash Conversion Cycle Formula Calculator Excel Template

Subsidy Amounts By Income Limits For The Affordable Care Act

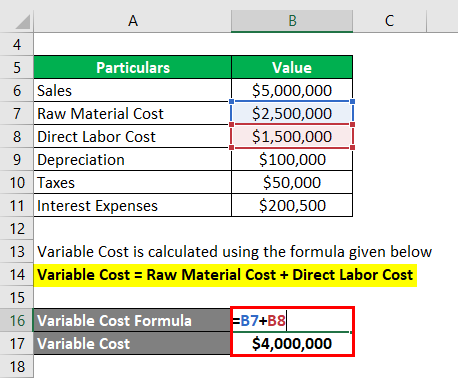

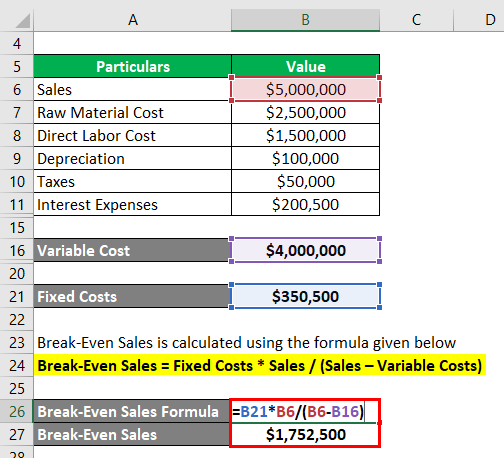

Break Even Sales Formula Calculator Examples With Excel Template

In Times Of Uncertainty Take Stock Of Your Cash For Financial Samurai

How I Earn Over 10 Passive Income With P2p Lending

Cash Conversion Cycle Formula Calculator Excel Template

How To Calculate Your Financial Independence Ratio

Operating Income Formula Calculator Excel Template

In Times Of Uncertainty Take Stock Of Your Cash For Financial Samurai

A Bank Loans A Family 90 000 At 4 5 Annual Interest Rate To Purchase A House The Family Agrees To Pay The Loan Off By Making Monthly Payments Over A 15 Year Period

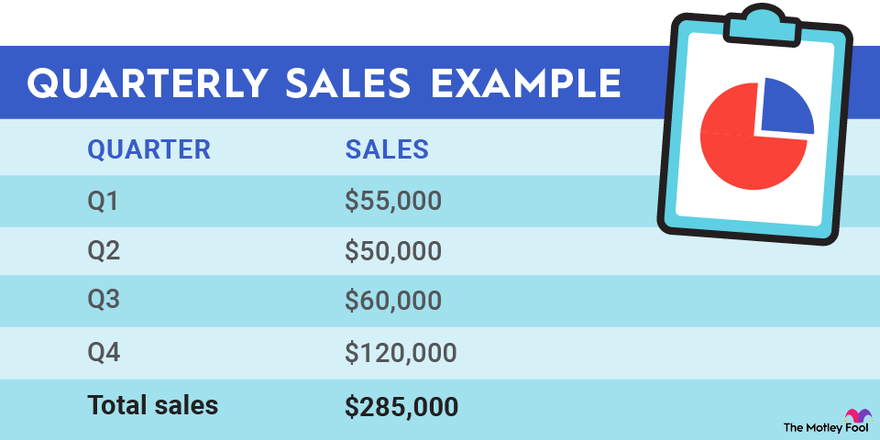

Run Rate Defined Explained

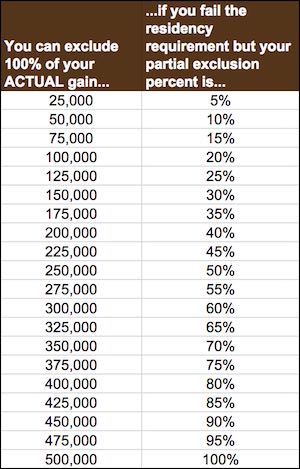

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

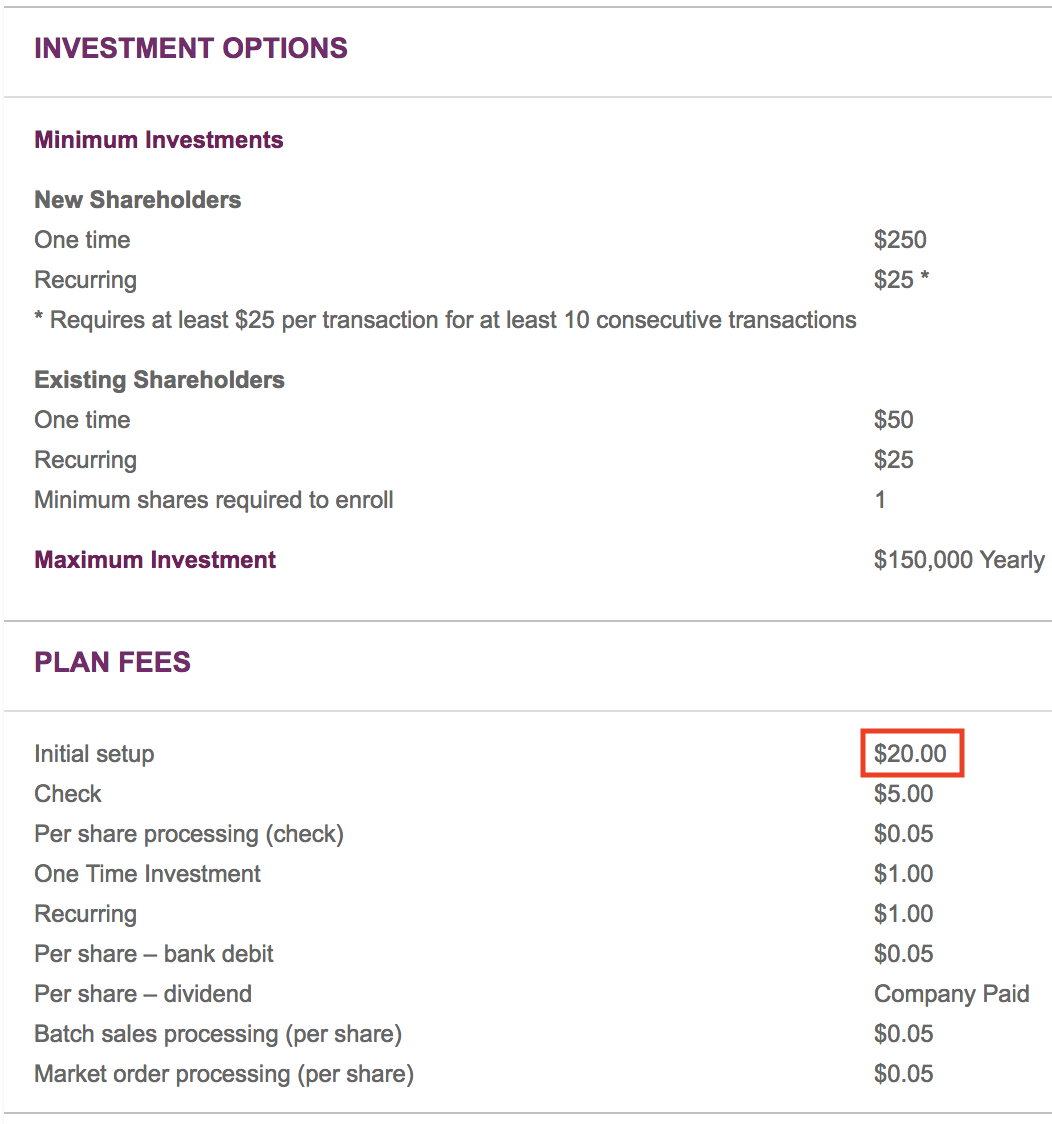

A Guide To Dividend Reinvestment Plans Drips

Break Even Sales Formula Calculator Examples With Excel Template

View Your 401k Like Social Security And Write It Off

50k Savings Challenge House Tracker Printable Money Savings Etsy Save For House Savings Tracker Saving Goals